A standalone product line could qualify as a profit center, as could a regional division of the larger company. Profit centers work under the supervision of managers who balance costs and revenues to drive profit. They’re responsible for all actions related to production and the sale of goods. Profit centers are accountable for generating revenue and profits for the company. They are evaluated based on their ability to generate revenue and profits, and their success is measured by KPIs such as revenue growth, gross margin, and net income.

- For example, a human resources department might forecast future hiring needs based on projected company growth, allowing them to allocate resources for recruitment and training effectively.

- Cost centers typically do not have the autonomy or authority to set prices or make strategic decisions that directly impact revenue generation.

- This focus on continuous improvement not only reduces costs but also enhances the overall effectiveness of the organization.

- This requires a meticulous approach to resource allocation and process optimization.

How Poor Data & Analytics Access Hinders Manufacturing Cost Understanding – And What To Do About It

An example of a profit center is a subsidiary, which is responsible for the amount of sales generated, as well as all costs incurred. Similarly, a country division is also treated as a profit center, as may a product line. Rather, it can be said that without profit centers, cost centers would still be able to generate profit (though not so much); without the backing of cost centers, profit centers won’t exist. For example, we will call the marketing department a cost center because the company invests heavily in marketing. A profit center is a branch or division of a company that directly adds or is expected to add to the entire organization’s bottom line. It is treated as a separate, standalone business, responsible for generating its revenues and earnings.

Profit Centers – Examples of Companies Operating as Cost Centers and Profit Centers

Their primary function is to manage and control costs while providing essential support services. Unlike profit centers, cost centers are evaluated based on their ability to operate within budgetary constraints and improve efficiency. For example, an IT department is a cost center that incurs expenses related to maintaining and upgrading technology infrastructure, which is crucial for the overall productivity of the company. The distinction between profit centers and cost centers lies at the heart of organizational structure and financial management. Profit centers are business units or departments within a company that are directly responsible for generating revenue. They have their own income statements and are evaluated based on their ability to produce profits.

Focus on Customer Satisfaction – Strategies for Effective Management of Profit Centers

Its profits and losses are calculated separately from other areas of the business. A profit centre is a type of responsibility centre wherein the manager of the centre or unit is responsible for both cost and revenue for the asset assigned to the division. In this way, the measurement of both the elements, i.e. cost (input) and revenue (output) is in terms of money.

The focus of management with regards to profitcenters, is to maximise revenues generated and limit costs incurred to optimiseoverall profitability of the department. By separating costs and revenues into distinct centers, organizations can make more informed decisions about allocating resources. Cost and profit centers are essential tools for organizations to achieve their goals. A profit center is a reporting unit of a business that is responsible for profits generated.

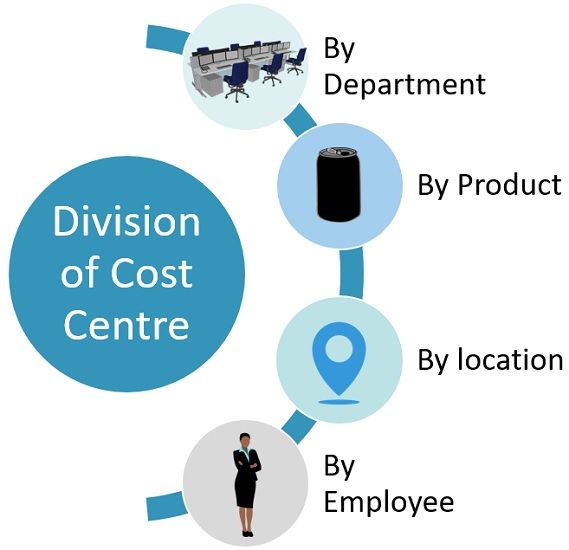

Examples of Cost Centers

These units are often the backbone of operational support, ensuring that the essential functions of the company run smoothly. By focusing on cost management and operational excellence, cost centers help maintain a streamlined workflow, which is crucial for the productivity of profit-generating units. For instance, a well-managed human resources department can improve employee satisfaction and retention, leading to a more motivated and efficient workforce. Cost centers are evaluated based on their ability to control costs, optimize resource utilization, and achieve budgeted targets. Key performance indicators (KPIs) for cost centers include measures like cost variances, cost per unit of output, and cost reduction initiatives. Regular performance evaluations help identify areas of improvement and drive operational efficiency.

He then said that there are only cost centers in a business and no profit center. If any profit center existed for a business, that would be a customer’s check that hadn’t been bounced. So a cost center debt to equity d helps a company identify the costs and reduce them as much as possible. And a profit center acts as a sub-division of a business because it controls the most important key factors of every business.

A cost center must stick to a budget and limit any unnecessary expenditure as part of its main function. For example, an accounting department doesn’t generate profit but it does control expenses by keeping financial statements and accounts in order. As a start-up business grows into a thriving company, it might need to separate into different departments. Some, like sales, are concerned with generating revenue, while others focus on other tasks like accounting and finance. Here’s a closer look at the difference between a cost center vs profit center within the same company. Cost centers typically have limited decision-making authority, as their primary role is to cost-effectively provide support and services to other parts of the organization.

Leave a Reply