However, this financial is a wonderful selection for homeowners wanting a good antique financial sense and you may who happen to live close by one of their banking metropolises in California, Massachusetts, Connecticut, New york, Wyoming, Florida, and you can Oregon.

Very first Republic Mortgage Realities

As lender cannot render one government-backed mortgage loans, it can function loads of expertise apps, in addition to a keen Eagle Area home loan and you may an All-in-one to Buy so you’re able to Build so you’re able to Long lasting money alternative.

First Republic just originates mortgage loans in certain of the service nations, that have alongside ninety five percent of their total loans originating from Ca, New york, and you can Massachusetts.

Fixed-Price Fund

It traditional mortgage sorts of brings higher level balance toward complete financing identity, due to the fact interest rates and you will monthly installments are closed in when you look at the origination months and do not change-over day. Very loan providers give terms of fifteen or three decades, though some convey more versatile options that enable for maximum modification.

This mortgage option is most popular which have homebuyers who’re planning to stay in one to location for several years of energy and people in search of an easy-to-funds financial. Although not, Very first Republic’s webpages will not indicate their particular repaired-rates financial possibilities.

Adjustable-Price Loans

Consumers that unsure regarding their enough time-title arrangements can benefit using this varying financial solution, since it also provides a reduced carrying out interest rate than simply repaired-rate finance. Once an introductory months, always, three, five, 7, otherwise ten years, the pace and you can monthly payment matter have a tendency to immediately to change most of the seasons to your field directory.

Terrible field efficiency may cause rates to rise, which could force individuals to invest furthermore the full lifestyle of the mortgage. It is undecided regarding Earliest Republic’s website the newest changeable prices one to it offers.

Crossbreed Adjustable-Price Mortgage

Which Earliest Republic expertise home loan system is aimed at consumers exactly who are intending to build their particular home. The mortgage talks about borrowers towards the full-length of the property-strengthening endeavor, regarding residential property buy toward completion of the house and you will past.

Which mortgage is available while the possibly a fixed- or adjustable-rates financing which have a selection of title alternatives and can help borrowers get rid of purchase can cost you. Bundling this type of normally separate loans on the one is time-rescuing and you will financially sound because eliminates content deal will cost you.

Trips and you can Second Mortgage brokers

Homeowners looking to purchase or re-finance a holiday domestic will benefit out of this home loan type of, since it has actually an easy and you can fast pre-qualification procedure.

First Republic also offers a wide variety of second home loan alternatives which have flexible fees words, as well as repaired-rates, adjustable-rates, and you will hybrid changeable-rates financing, that feature a fixed rates inside basic several months, followed by change to help you a varying price.

Eagle Area Loan System

Which mortgage system has the benefit of some of Earliest Republic’s most acceptable interest cost having consumers looking to purchase otherwise refinance a primary home in one single of the bank’s census tracts. Which mortgage program brings conventional fixed-rates mortgages and no prepayment punishment.

Basic Republic Financial Consumer Sense

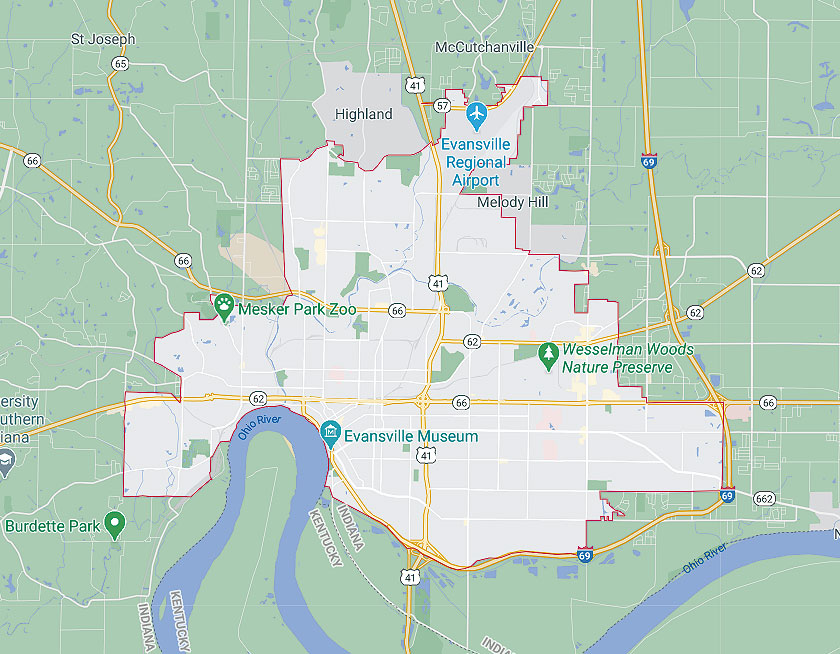

First Republic Bank simply starts loans San Acacio CO mortgage brokers in the California, Massachusetts, Connecticut, Nyc, and you may Oregon, and that rather constraints the scope of the mortgage functions. The majority of the bank’s actual twigs are located in Ca, so it’s difficult for aside-of-condition consumers to work alongside so it lender to the a face-to-deal with basis.

While doing so, Basic Republic’s not enough authorities-recognized mortgage loans inhibits individuals having reduced credit scores and you will minimal borrowing records out of qualifying to own a mortgage having low down money.

As lender does offer a number of specialty software, none are dedicated to bringing sensible credit answers to reasonable-to-moderate-income people outside of specific designated census tracts.

Leave a Reply